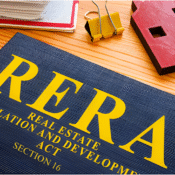

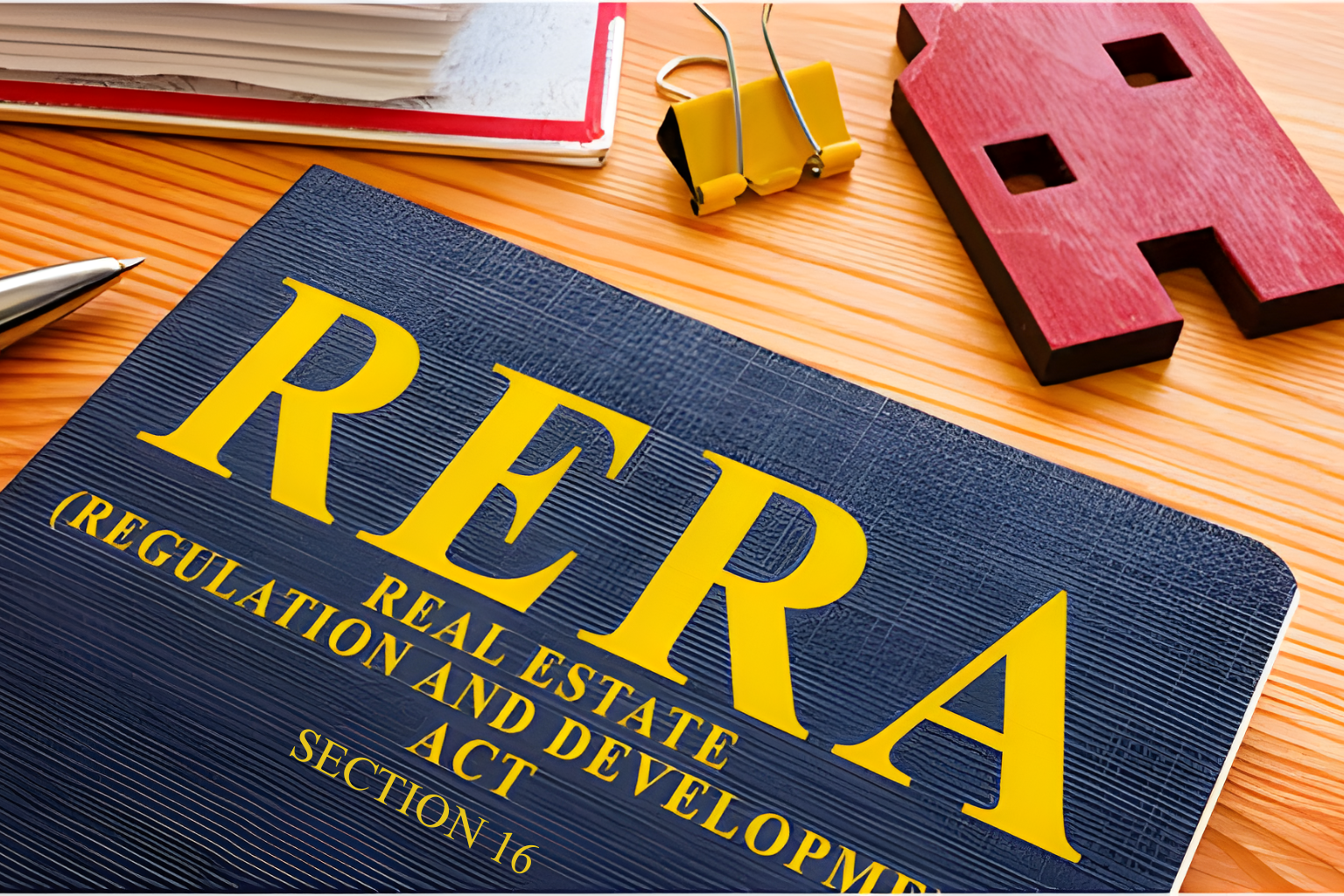

DEVELOPERS MUST HAND OVER SECTION 16 INSURANCE DOCUMENTS TO HOMEBUYERS

Builders are legally bound to provide mandatory section 16 insurance documents to homebuyers or bear the cost of repair themselves.

The obligation to obtain and transfer insurance coverage under the Real Estate Regulation & Development Act is not optional and cannot be avoided, even after maintenance of a housing project is handed over to an apartment owners association.

The promoter is required to obtain the insurance, pay all premiums up to handover and thereafter transfer the benefits of such insurance to the association of allotees.

Buyers should insist on receiving copies of insurance policies at the time of possession. Without these documents, homebuyers cannot maintain or enforce insurance coverage after handover, leaving them exposed in the event of damage.

Under RERA, promoters are liable for structural defects for five years after possession. However, in the absence of Section 16 insurance, homeowners would be forced to pursue claims directly with builders rather than through insurance, significantly increasing financial and legal risk.

SECTION 16 INSURANCE RERA Section 16 insurance documents refer to the mandatory insurance policies a real estate promoter must obtain and hand over to homebuyers or their association under the Real Estate Regulation and Development Act, 2016. These documents cover risks like fire, floods, and structural damage, providing a critical financial safety net to buyers upon taking possession.

VP Research & Strategy

DAAMRI DEALS PVT LTD ALPHA 1 COMMERCIAL BELT GREATER NOIDA UP